According to a recent study,

"Over 94% of new business fail during the first year of operation". For many shutdowns of the businesses, lack of

funding is a common reason. I believe money can be a powerful weapon which can

help you when you enter in the war of competition.

Many ideas emerge in paper and out of them many

get vanished due to lack of funding to take it for R&D and market. Money is

another fuel of your business. Many people drop the idea of becoming an

entrepreneur mainly because they don't know how to fund their business plan.

Since the

importance of money is indispensable therefore, in this Blog, I am going to

tell you the different ways by which you can raise the funding of the business

without taking any stress.

.

1. Bootstrapping

Self-funding which is also known as Bootstrapping

is an effective way of startup financing. If you are a first-time entrepreneur then

it may be hard for you to convince investors to invest in your business. Bootstrapping

is also effective because you don't want to lose your own money and for this,

you work hard. In this way you can make an impression in front of

investors. In the same way, you take help from your relatives and friends. It

is easier since it requires very less paperwork and in most situations, family

and friends are flexible with the rate of interest.

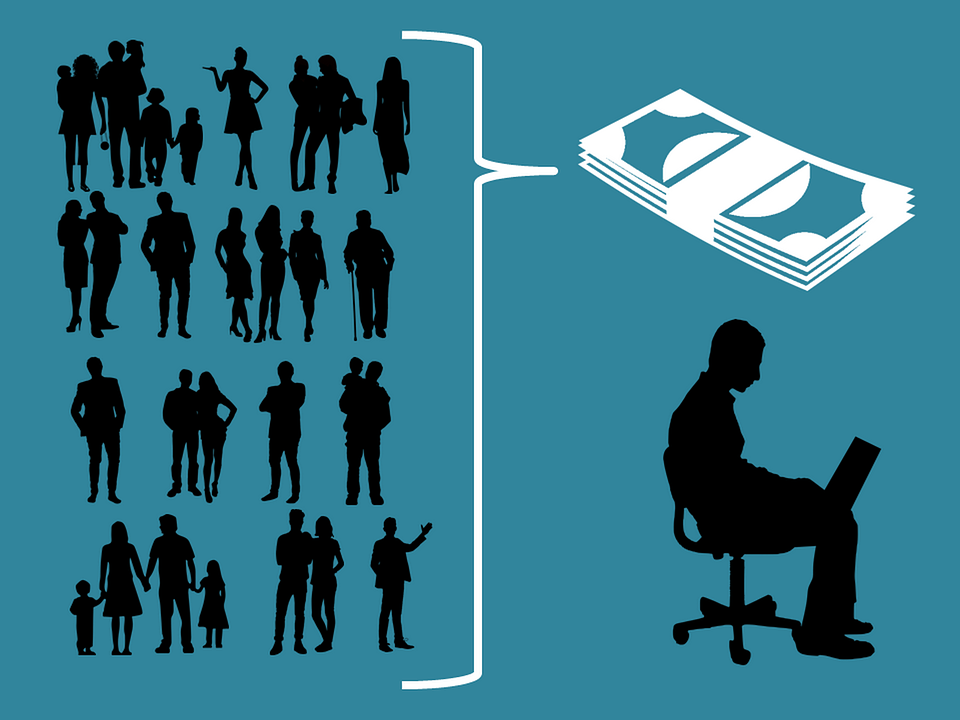

2. Crowdfunding

If you are not sure if there will be any demand for the product on

which you are working on and want to get rid of professional investors and

brokers, you can go with Crowdfunding as an option to get capital

for your business. Crowdfunding is like taking a loan, pre-order,

contribution or investments from more than one person at the same time.

Some of the popular Crowdfunding sites in India are

Indieggo, Wishberry, Ketto, Fundlined, and Catapoolt.

In USA Kickstarter, Rockethub, DreamFunded, one west, and GoFundMe are

popular crowdfunding platforms.

|

Working of Crowdfunding-

As you are an entrepreneur you put up a detailed description of your business

in a Crowdfunding platform, you will have to mention the goals of your

business, plans for making a profit, reasons for the need of funding, total

fund you need, etc.

People come in these platforms and if they read about your need and like your

idea, they can provide fund for your business.

3. Angel investment

Angel investors are individuals who have an excess amount of money.They keep in search of a good proposal and Idea.The take more risks in investment for higher returns.They can also offer mentoring or advice alongside capital.Giant companies like Google, Yahoo and Alibaba got up push-start from the Angel investors.

This kind of investment generally occur during the early stages of the business and investors expecting and up to 30% equity.

|

4. Venture capital-

Venture

capitals are professionally managed funds that invest

in companies that have huge potential. Companies which have passed its start-up

phase and already generating revenue can get Venture Capital investment.

Fast-growing companies like Flipkart, Uber, etc with an exit strategy

already in place can gain up to tens of millions of dollars from Venture

Capitals.

VCs look to recover their investment within 3 to 5 years time

window.

If you have a product that is taking longer than that to get to the market,

then Venture Capital Investors may not be very interested in you.

Some of the well known VCs in India are Nexus Venture Partner,

Helion Ventures, Kalaari Capital and more.

|

5. Business Incubators and Accelerators-

Incubators are like parents to a child who Nurtures the

business, providing shelter, tools, and training and network to a business and help/assist/nurture

a business to walk, while Accelerator helps to run and take a giant leap.

In the beginning days of a startup, Incubator and Accelerators

can be proven as a good funding option.These programs normally run for four to

eight months and require the time and commitment from the business owner.

During this time you can make a good connection with Mentors, Investors and

other Counterparts who are using the same platform.

These can be found in almost every major cities.

In India, the popular names are Amity Innovation Incubator, Angel Prime,

CIIE, IAN Business Incubator.

|

Now, after so much

about ways to funding, its time to take a small break, but wait next five ways

are on its way. So stay tuned with Scoobynel to get know about the next Five

ways to get funding for your business.

"fire your boss and do whatever you like" a 100$ dollar startup -the best book you can also buy by clicking on it

STAY SAFE AND STAY HEALTHY ;)

Well done 👌

ReplyDeleteBadhiya👌🔥

ReplyDeleteA plan entrepreneur realizes how to oversee hazard; they understand taking danger. Resume Builder

ReplyDelete